Tokyo, 24 June, /AJMEDIA/

Asian shares were mostly lower Monday after U.S. stocks coasted to the close of their latest winning week on Friday, even as Nvidia ’s stock cooled further from its startling, supernova run.

U.S. futures were mixed and oil prices were little changed.

In Tokyo, the Nikkei 225 index rose 0.5% to 38,804.65, making it the sole major benchmark in Asia to post gains on Monday.

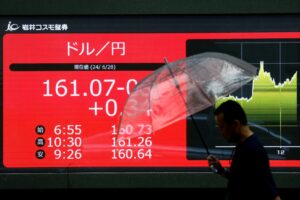

The yen weakened to 159.72 to the dollar. The dollar closed at 159.77 yen on Friday.

Minutes of the Japanese central bank’s last policy meeting released Monday put the yen under renewed pressure as it indicated that “Any change in the policy interest rate should be considered only after economic indicators confirm that, for example, the CPI inflation rate has clearly started to rebound and medium-to long-term inflation expectations have risen.”

Meanwhile, it was reported that Masato Kanda, a vice minister of the Japanese Finance Ministry, said officials were prepared to intervene to support the currency at any time.

Elsewhere, Hong Kong’s Hang Seng dropped 0.8% to 17,893.33, while the Shanghai Composite lost 0.7% to 2,978.50.

Australia’s S&P/ASX 200 dipped 0.8% to 7,733.70. South Korea’s Kospi shed 0.7% to 2,766.13.

On Friday, the S&P 500 slipped 0.2% to 5,464.62, but it remained close to its all-time high set on Tuesday and capped its eighth winning week in the last nine. The Dow Jones Industrial Average edged up less than 0.1% to 39,150.33, while the Nasdaq composite dropped 0.2% to 17,689.36.

Nvidia again dragged on the market after falling 3.2%. The company’s stock has soared more than 1,000% since October 2022 on frenzied demand for its chips, which are powering much of the world’s move into artificial-intelligence technology, and it briefly supplanted Microsoft this week as the most valuable company on Wall Street.

But nothing goes up forever, and Nvidia’s drops the last two days sent its stock to its first losing week in the last nine.

Much of the rest of Wall Street was relatively quiet, outside a few outliers.

In the bond market, U.S. Treasury yields initially fell after a report suggested business activity among countries that use the euro currency is weaker than economists expected. Concerns are already high for the continent ahead of a French election that could further rattle financial markets.

The weak business-activity report dragged down yields in Europe, which at first pressured Treasury yields. But U.S. yields recovered much of those losses after another report said later in the morning that U.S. business activity may be stronger than thought.

Overall output growth hit a 26-month high, according to S&P Global’s preliminary reading of activity among U.S. manufacturing and services businesses. Perhaps more importantly for Wall Street, that strength may be happening without a concurrent rise in pressure on inflation.

“Historical comparisons indicate that the latest decline brings the survey’s price gauge into line with the Fed’s 2% inflation target,” according to Chris Williamson, chief business economist at S&P Global Market Intelligence.

The Federal Reserve is in a precarious spot, where it’s trying to slow the economy through high interest rates by just enough to get high inflation back down to 2%. The trick is that it wants to cut interest rates at the exact right time. If it waits too long, the economy’s slowdown could careen into a recession. If it’s too early, inflation could reaccelerate.

The yield on the 10-year Treasury edged down to 4.25% from 4.26% late Thursday. The yield on the two-year Treasury, which more closely tracks expectations for Fed action, dipped to 4.73% from 4.74%.

In other dealings Monday, U.S. benchmark crude oil fell 8 cents to $80.65 per barrel in electronic trading on the New York Mercantile Exchange.

Brent crude declined 5 cents to $84.28 per barrel.

The euro rose to $1.0710 from $1.0693.

© Copyright 2024 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed without permission.