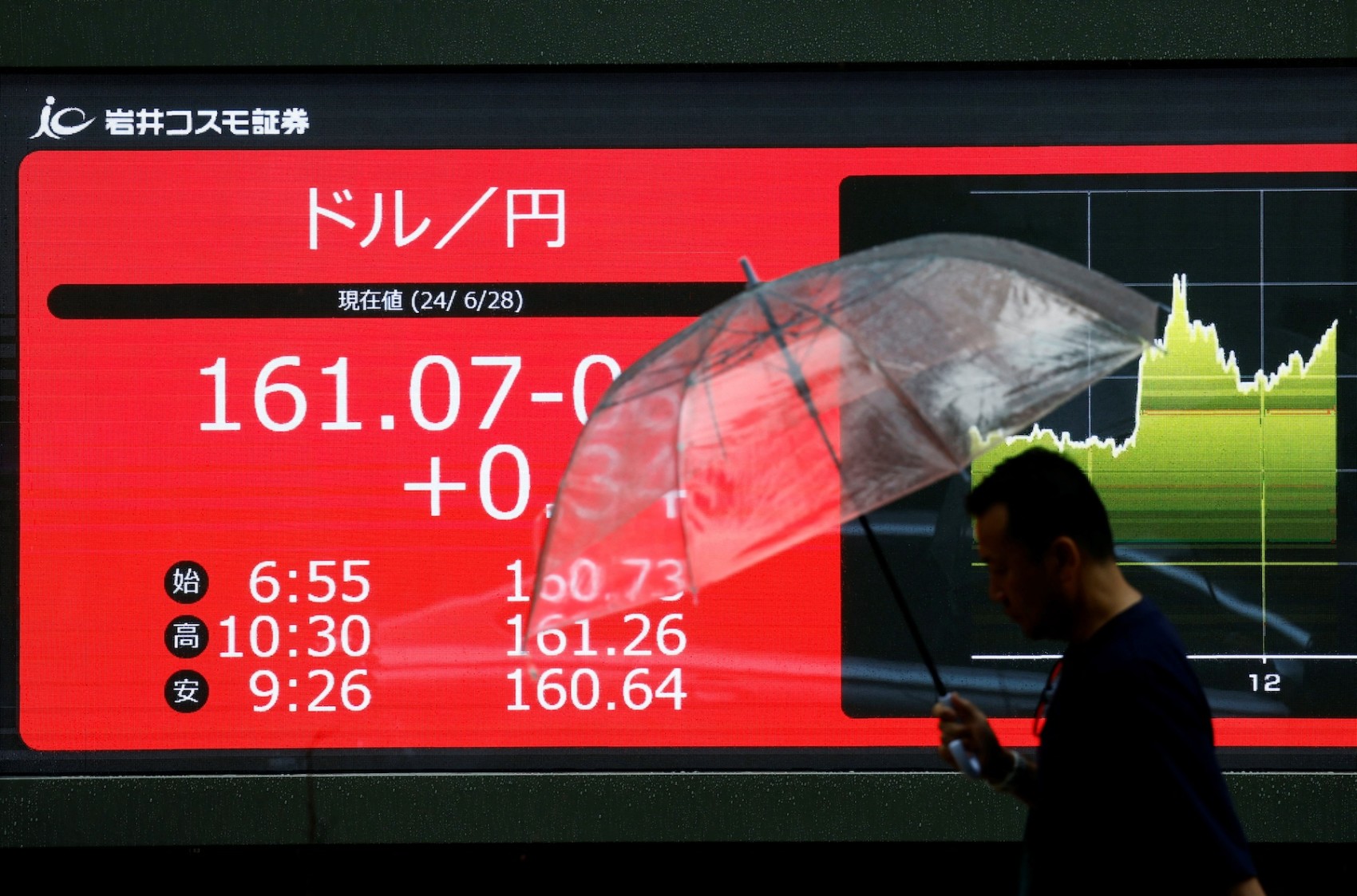

Tokyo, 28 June, /AJMEDIA/

The yen tumbled to hit a fresh 37-year low in the lower 161 range against the U.S. dollar Friday in Tokyo, with warnings from Japanese officials over a possible yen-buying intervention having limited impact on the market.

The Japanese currency’s weakness comes ahead of key U.S. inflation data to be released later in the day amid speculation that the Federal Reserve may keep interest rates elevated for longer than expected on the back of recent solid economic data.

The yen also sank in the 172 range against the euro, its lowest level since the European currency was introduced in 1999.

At 5 p.m., the dollar fetched 160.92-94 yen compared with 160.72-82 yen in New York and 160.54-56 yen in Tokyo at 5 p.m. Thursday.

The euro was quoted at $1.0696-0698 and 172.13-17 yen against $1.0699-0709 and 172.03-13 yen in New York and $1.0689-0691 and 171.61-65 yen in Tokyo late Thursday afternoon.

The yield on the benchmark 10-year Japanese government bond fell 0.030 percentage point from Thursday’s close to 1.040 percent, as investors bought the debt following a bond-buying operation by the Bank of Japan.

The yen fell to its lowest level since December 1986, briefly hitting 161.28 in the morning amid lingering prospects that the interest rate differential between Japan and the United States will remain wide. The U.S. personal consumption expenditure for May, set for release on Friday, will be closely watched by the Fed to gauge inflation.

Japanese officials have repeatedly issued verbal warnings over the yen’s volatile movement, with authorities conducting a yen-buying intervention in April and May.

After the yen hit the new 37-year low, Finance Minister Shunichi Suzuki warned Japan will take “appropriate” steps against excessive volatility, adding that he was “deeply concerned” about the negative impact that rapid and one-sided currency movements would have on the domestic economy.

“Although wariness over another intervention existed in the market, his comments were not particularly new,” said Masahiro Ichikawa, chief market strategist at Sumitomo Mitsui DS Asset Management Co.

While it was difficult to predict when authorities will step in, the decision “is likely to be based on the pace of the yen’s fall, rather than a certain threshold,” Ichikawa said.

Stocks ended slightly higher as the yen’s depreciation lifted some export-related issues such as Toyota Motor and Honda Motor.

The 225-issue Nikkei Stock Average ended up 241.54 points, or 0.61 percent, from Thursday at 39,583.08. The broader Topix index finished 15.93 points, or 0.57 percent, higher at 2,809.63.

On the top-tier Prime Market, gainers were led by insurance, bank, and securities house issues.

© KYODO